After 35 years in commercial lending, Annette Jorgensen has witnessed a surge in business transitions with acquisition and stock buyout inquiries on the rise in 2025. As Vice President of SBA Business Development at American Riviera Bank, she has the expertise to identify one reason for this shift - a generation of business owners is now ready to exit and this will continue for the many years to come.

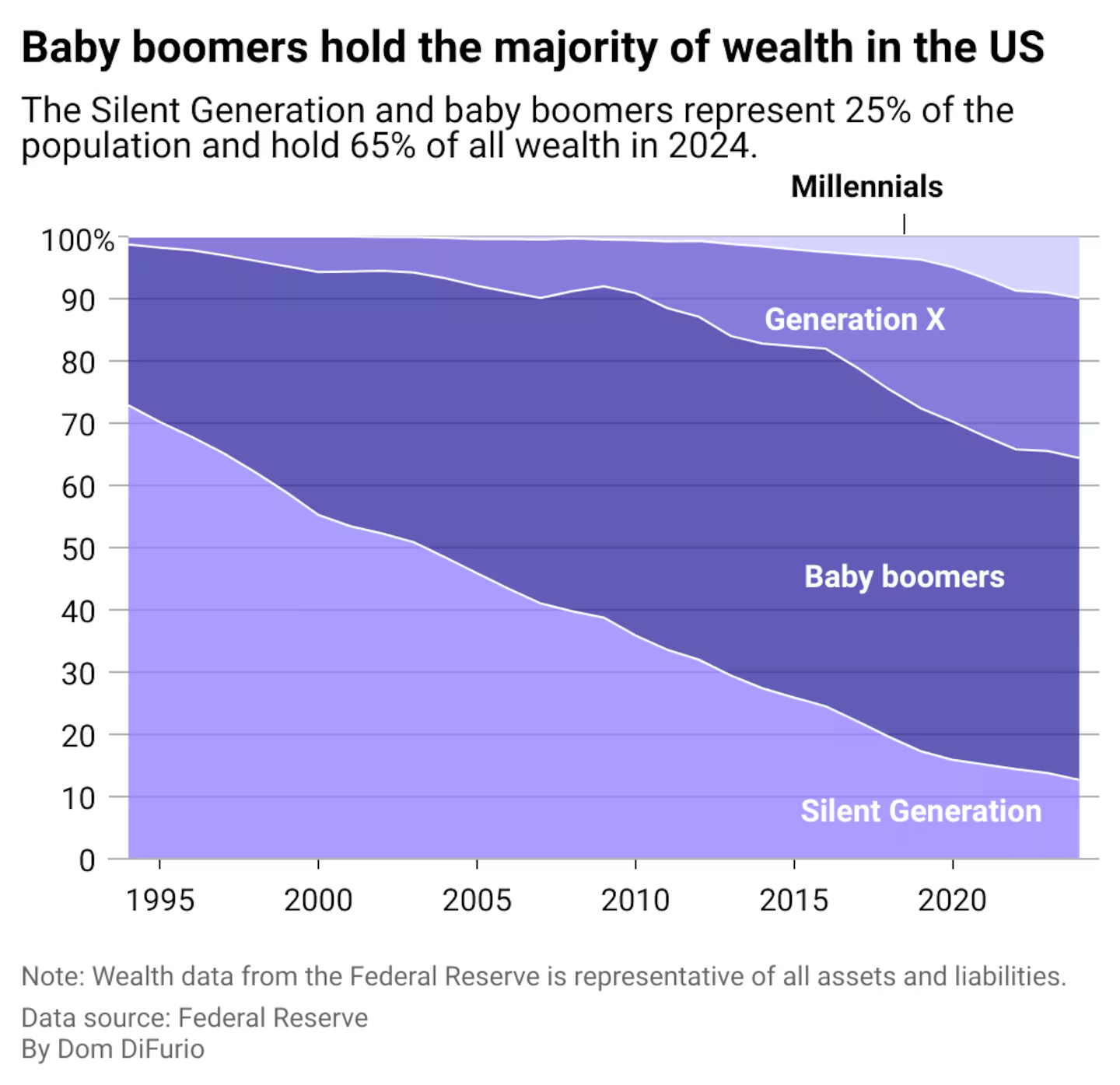

In what is often referred to as the Great Wealth Transfer, there is an estimated $84 trillion in assets that is expected to change hands in the next 20 years. While the average age of business owners has dropped from 50 to 40, currently 47% owned by Gen X. Another 40% of businesses are owned by Baby Boomers and yet only one-third of business owners have indicated they have a formal succession plan for their business.

"Everyone is aging," she explains. "Everyone that's had their business for 35 or 40 years is ready to consider their next chapter." Data from the U.S. Census Bureau supports this, stating that just over half (52.3%) of U.S. employer-businesses are owned by people who are at or near retirement age, those 55 and older.1

The answer to this next step is rarely straightforward, and many business owners discover they're unprepared for one of the most consequential decisions of their professional lives. Gallup research supports this as nearly 1/3 of business owners asked about long term plans stated they had no plans or were unsure of the future.

The pandemic created an unexpected holding pattern for business transitions. Business owners contemplating retirement in 2020 had to pause their plans when COVID struck and financials deteriorated. It has taken several years for these businesses to recover their value and stabilize their performance. This timeline means many are now engaging in succession discussions.

Succession planning requires planning, thoughtful consideration of options and consequences, and an understanding of valuation. Often the first question as to whether a stock buyout or asset sale is appropriate can be a challenge for business owners to answer. Ms. Jorgensen starts this conversation with one question: Are you selling the stock of your corporation, or are you selling the assets of the business?

"Very seldom do they know," Jorgensen admits, “Yet, the distinction matters enormously. In a stock buyout, the buyer acquires the corporation from day one and in an asset sale, the buyer forms their own entity and purchases specific assets, getting a clean slate through a bulk sale escrow that verifies no hidden liabilities exist.”

Stock buyouts are often driven by sellers because of tax advantages, though buyers inherit everything from the company's history. Asset sales offer buyers more protection but require more complex structuring. Understanding this fundamental choice requires working with a seasoned team of experts – from business bankers to attorneys to CPAs – early in the process, confirming the need for long term planning and preparation.

In addition to understanding the structure of the buyout, appropriate valuation is key. Many business owners have a number in mind for their exit however there can be a gap between perceived value and market reality. Business appraisals provide objective valuations, but may not account for an owner’s personal efforts building the business, which won’t directly translate in the financials. These conversations demand both financial sophistication and emotional intelligence—and they're much easier to navigate when you're not facing an imminent retirement deadline.

When identifying buyers, business owners may look within, from family members to current employees. Working with an internal buyer can be a part of the long term succession planning. As of November 2024, the SBA began allowing partial buyouts—meaning someone can gradually acquire ownership over time. This creates opportunities for multi-year transitions where a key employee or family member can buy in incrementally, reducing financial strain and allowing for knowledge transfer. Planning is essential and time must be considered. The loan process may take 60 days once a buyer is identified and terms are agreed upon but the preceding work—valuation, structuring, negotiation, legal documentation—can take months or years depending on complexity. To properly plan for a succession, the ideal time to engage with business bankers, attorneys, and CPAs is years before execution. This allows you to structure ownership properly, document processes, build value systematically, and identify potential buyers internally or externally.

Sometimes a tough personal transition becomes a pathway, as was the case with American Riviera Bank client, Annie Lopez.

As her marriage ended, Ms. Lopez faced a daunting question: what would happen to Quality Roofing, the roofing business she and her husband had built together? Her husband hadn't been actively involved in operations for three years, but untangling ownership during a divorce is never simple. That's when Annie was connected to Annette Jorgensen and discovered that the right banking partner could make all the difference. Jorgensen became the central coordinator working closely with Annie's divorce attorney, business attorney, and CPA to keep the entire team aligned while various legal proceedings unfolded.

"I tried to be a support and provide guidance on how we could structure a loan that allowed Annie to own the business," Jorgensen recalls. Today, Ms. Lopez owns Quality Roofing outright, standing as a proud example of women's leadership in the construction industry.

There are other considerations when transferring ownership that require a banker’s expertise. These may include processes for replacing signers on business deposit accounts, revisiting those with administrative access to the company’s bank account, an changing authorized users. American Riviera Bank’s Treasury Services Group can dive deep into financials to help plan for the future with confidence.

A comprehensive succession plan is vital to ensuring your business’s continuity and preserving its value, regardless of unexpected circumstances. Whether planning for retirement or preparing for unforeseen events, a well-structured succession strategy protects what you’ve built and provides peace of mind. Interested in exploring your options for this next step in your business lifecycle? Reach out to one of our local experts to learn more.

1. https://news.gallup.com/poll/657362/small-business-owners-lack-succession-plan.aspx

Previous: Cyber-Enabled Crime Next: Fraud Risks During the Holidays